-

How cutting 70% of category inventory increased sales?

- by OmnibusCategory: Assortment Optimization

SITUATION

Too much stock, too much space, too little clarity

This is the case of a toy department in a grocery supermarket.

The case shows how decisive moves reduced category stock by 70%.

How much of this did we pay in falling sales? Zero. Stock reduction didn’t hurt the category sales.

On contrary. The sales increased.

It’s a real case. But not based on the classic optimization attempts.The starting point: a lot of shelf space for category

| Bay1 | Bay2 | Bay3 | … | Bay18 |

|———————————-|

TOTAL ≈ 22.5 mThe category position was good but highly underperfoming in terms of sales per m2.

Before any analysis or optimization, toy Category occupied 18 gondola bays — more than 22 meters of linear shelf space.

With over 1000 SKUs stock rotation was slow.

What Analysis Reveals?

We loaded the data into Omnibus Data engine and helped it get to some conclusions.

Despite wide assortment and heavy stock, profitability and rotation were poor.

Below you can see that more than 20% of high rotating stock generated 60% of sales …SKUs vs Sales Volume distribution (source: Omnibus Data Engine)

… And there was more.

Even with a simplified dataset (1 category, limited attributes), the Data Engine logic revealed where performance truly lived:

- Sales extremely concentrated as the top 2% SKUs generate 22,4% sales volume

- The long tail fills disproportionate stock and space – the last 30% of SKUs bring only 6% of sales

- Seasonality amplifies the imbalance – stock inflates during peak season but never really decreases afterward, long-tail becomes wide and heavy, heavy

Aha insight

Shopper behavior insight: Parents and children buy impulsively; fewer SKUs make choice easier and increase the likelihood of conversion.

And that special superpower moment: if we cut the assortment, we don’t only reduce the stock and release the capital, but we actually trigger additional sales.

Shopper Logic applied

Neuroscientific shopper insights are essential part of Shopper Logic behind the model. Too much choice blocks. That’s called paradox of choice. Shoppers faced with abundant SKUs often feel anxious, delay decisions, or regret their purchase.

Role

Toys in grocery supermarkets are not a Destination category, but a Routine/Impulse add-on.

Strategy

Limit breadth and depth, focus on shelf productivity and impulse hit logic!

Shopper Logic

Parents and children buy impulsively; fewer SKUs make choice easier and increase the likelihood of conversion.

From Insight to Decision/Action

Insight 1

Top 10 SKUs generate

55% of sales

Move 1

Cut the long tail

- rotation > 1

- share of sales > 0,5%

- stock clog removal

- match seasonality peaks

Insight 2

Long tail items eat space & cash

- The huge long tail with almost 0 rotation

- 70% of stock sits at wrong place

- Low rotation kills profitability

Move 2

Expand the heroes

- more facings

- stronger visibility

- dual location & promo tie-in

- match seasonality peaks

Insight 3

Seasonal spike but no exit plan

Move 3

Seasonal Exit protocol

- 0 stock rule post-peak

- 30-45-60 day liquidation windows

- automated monitoring KPI

Before

After

Shelf Space - Before = 18 bays

Shelf Space - After = 8 bays

OUTCOME

STOCK

-70% DOWN

SALES

+10,4% UP

Why this works?

This is not a toy story only. The logic applies to any category with

- strong SKU concentration

- seasonality

- long tails

- limited space

The Data Engine simply makes the logic visible – fast.

Think of household gadgets in hypermarkets, hand tools in DIY stores, toys for dogs & cats in Pet food stores, office accessories in stationery stores, gift books & illustrated editions in bookstores, and many, many more.

These categories don’t suffer from under-assortment. They suffer from unchallenged abundance or be it overstock.

Next sensible step if this resonates?

New wave category management will lead you from insights to impact

At Omnibus, we work with retailers and suppliers to turn data signals into actionable insights — and insights into actual category decisions.

This includes Data Engine prototypes, New Wave Category Management programs, and hands-on workshops focused on real pilots, where theory is checked on-the-go.Frameworks, tools, and workshope designer for real retail impact.

A short conversation to see if a pilot or workshop makes sense.

Challenge. Learn & improve on pilot projects. Then scale for real impact.

Read more016Omnibus

-

Assortment Optimization: The Power of Relevance

- by OmnibusCategory: Assortment Optimization

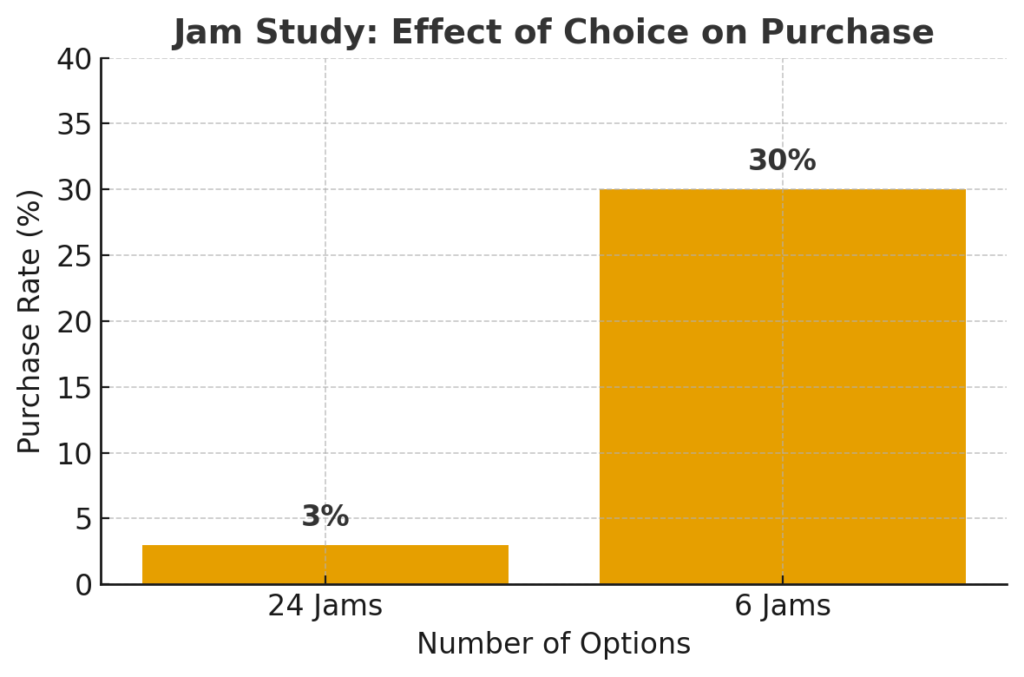

Beyond a certain point, each additional SKU reduces overall sales and share—i.e., more choice undermines conversion.You’ve probably heard about the jam study, where with 24 varieties available, only 3% of people actually bought one. But when 6 varieties were available, almost 30 percent did. Too many SKUs don’t just clutter your shelves—they block your customers’ decision-making.

Barry Schwartz – The Paradox of Choice (2004)

Too much choice blocks. Shoppers faced with abundant SKUs often feel anxious, delay decisions, or regret their purchase.

Don’t overlook the book’s subtitle: “Why more is less?

In retail, more is not always better — abundance can lower conversion.Behavioral science informs us: “with so many options to choose from, people find it very difficult to choose at all” (a phenomenon Barry Schwartz dubbed “the paradox of choice”).

To cut through the noise, retailers should anchor category roles and strategies in shopper profiles of their customers – asking- why they come to your store?

- what they expect to find?

- how they prefer to decide?

WHICH PRODUCTS ARE REDUNDANT?

A common situation is a shopper walking store aisles of the grocery supermarket. On one shelf, six nearly identical yogurts from different suppliers. On another, dozens of energy bars, many duplicates, with slow movers shoved to the back. Shoppers glance, hesitate, and often walk away. Some don’t even come into the store – they walk straight across the street to the discounter with leaner assortment.

It’s only natural that a retail manager asks:

“Which products on these shelves are hurting me more than helping — and how do I know?”

Which SKUs deserve to live — and which are noise?

The path to clarity lies in connecting shopper logic with category purpose.

CATEGORY ROLE AND STRATEGY

Assortment optimization must begin with clarity of role and strategy, before SKU decisions.

When role and strategy are explicit, SKU decisions are less ad hoc and more systemic.

Pair that with shopper decision logic (as in the Customer Decision Tree), and your roadmap emerges: for each shopper mission, you know which sub-decisions matter (brand, pack size, feature, price), and which SKUs are indispensable.

Assortment Decisions based on relevancy

Shopper Profile

Key shopping mision?

Shopping motive that brings the shopper into your store. What are succesfully met expectations?

Category Role

Why a category lives in your store?

Destination

Routine

Convenience

Image

SeasonalCategory Strategy

How each category pulls its weight?

traffic attractor

margin engine

loyalty builder

convenience anchor

Assortment Decision

Rules for assortment optimization

Breadth

Width

Length

ConsistencyIn practice, you’d overlay a Role × Strategy matrix, then map the customer decistion tree nodes to that matrix to see which SKUs are critical. e.g.:

Category Roles with examples

Destination

Infant formula, baby consumables

must offer breadth and depth across trusted brands—its strategy is traffic & loyalty

Routine

cooking oils

might require fewer SKUs, emphasizing consistency, turnover, and margin — strategy is steady sales

Image

premium category

might trade breadth for curated selection, highlighting exclusivity or signature SKUs.

A CASE OF CHOICE PARALYSIS

Let’s revisit a Slovenian supermarket chain’s baby category (diapers, formula, accessories) — a category that originally aimed to be a Destination draw. Over time, it got bloated:

Choice overload: multiple near-duplicate SKUs every year, justified by supplier pushes.

Shoppers overwhelmed by choices; experienced parents sometimes turned to specialty baby stores.

Operational inefficiency: Store staff struggled with out-of-stocks while many slow movers clogged shelf space.

Low SKU productivity: Profitable SKUs got buried under the noise of marginal ones. Instead of being a beacon for parents, it became a hassle. The baby category lost its clarity.

That pattern, replicated across many categories, leads to:

- Lower turnover per SKU

- Hidden winners

- Shopper dissatisfaction, confusion, lost conversion

- Higher inventory & logicstics cost

Without role/strategy anchoring, each SKU decision is a small gamble. Over time, the bets stack against you.

STRATEGIC & SHOPPER CENTRIC SKU DECISIONS

When your team asks, “Does this SKU support our role-strategy-shopper logic?” the answer becomes obvious, not controversial.

- Destination → broad but anchored in your strongest tiers

- Routine → lean, reliable, no-nonsense

- Image → curated, premium, high-impact

And the clutter dissolves—not by random cuts but by sculpting around shopper missions.

In our Assortment Optimization Workshop retailers bring this to life: they overlay CDT maps on the categories, assign roles & strategies, and make SKU-optimization decisions in guided steps.

The result? Fewer SKUs, clearer shelves, better turnover, and stronger shopper trust.

LESS IS MORE – THE DRASTIC WAY

Take another real life example. During our assortment optimization workshop, we came to a conclusion: streamline toys department in a local supermarket from 19 bays to 6 bays. That’s 70% cut!!!

We could afford this because we applied the shopper logic.

The Toy category example from supermarket

Role

Toys in grocery supermarkets are not a Destination category, but a Routine/Impulse add-on.

Strategy

Limit breadth and depth, focus on shelf productivity and impulse hit logic!

Shopper Logic

Parents and children buy impulsively; fewer SKUs make choice easier and increase the likelihood of conversion.

Assortment Optimization Model (AI supported)

AI assortment Model

Cut relentlessly low-turning SKUS

-70%Outcome

Category Sales

+10,4% UP

Reduced complexity

Easier space management

Clearer presentation

ALVIN – OUR AI STRATEGIC ASSORTMENT MODEL

Over the years we’ve buil many optimization cases and trained our new AI test model named Alvin, with this data. Today, Alvin answers 3 key assortment questions:- Role → Why does this category exist in your store?

- Strategy → How is this category expected to deliver—traffic, margin, image, loyalty?

- Shopper Logic → How do shoppers actually decide within this category?

- Duplicated SKUs: products with overlapping roles (e.g. three nearly identical strawberry yogurts).

- Tail SKUs: items contributing <1% to sales and no unique shopper decision value.

- Overlapping formats: e.g. too many 1.5L colas in similar price bands.

Outcome

A recommendation list of potential cuts, clearly marked as low risk or high risk based on shopper logic

BALANCING BREADTH AND DEPTH OF ASSORTMENT

One of the central trade-offs in assortment optimization is between

breadth: how many different SKUs or variants you offer.

and

depth: how much stock or how many facings per SKU.

Let’s illustrate with yogurt by following highly successful discounters like Aldi and Lidl as an example: they cover breadth by offering key shopper missions—plain natural yogurt, fruit yogurt, Greek style, organic, lactose-free, even sheep- or goat-milk options. Each signals awareness of different shopper needs.

Alexander Chernev – When More is Less and Less is More (2003) Variety can be positive if it is organized and meaningful. Relevant, segmented assortments (good–better–best, clear missions) raise satisfaction and perceived freedom. But cluttered, random assortments undermine confidence and reduce buying likelihood.

But within each segment, they keep depth tightly limited. Instead of six strawberry yogurts across five brands in multiple pack sizes, discounters usually carry one carefully chosen SKU per segment—often their private label.

This creates clarity for shoppers and ensures every facing moves quickly.

The result is not just leaner shelves but also higher turnover and stronger negotiating power. With volume consolidated into fewer SKUs, discounters achieve lower costs, better margins, and the ability to offer aggressive price/value propositions. Shoppers learn they won’t drown in duplicates; they’ll reliably find what they need at the best price.

This strategy demonstrates that assortment optimization isn’t about cutting choice—it’s about curating breadth while limiting depth to make every SKU count. For categories like yogurt, it’s the difference between clutter and clarity, hesitation and purchase.

WHICH ONE MATTERS (IN THE EYES OF SHOPPER)

Assortment optimization is about curating the right mix that matters to your shoppers. The yogurt shelves showed how it works: cover the essential breadth of missions (from plain to organic), but strip away duplicate depth that clutters decisions. But that works as yogurt is a routinely bought category, a staple that reinforces the promise: “You can do your whole shop here.” for different shopper profiles, parents, kids, health-conscious shoppers. Thus it works as routine x traffic driver where traffic leads towards profit driver.

With role and strategy as your compass, assortment shifts from confusion to clarity.

Cluttered shelves slow shoppers down; streamlined ones build trust, turnover, and value. Done right, optimization doesn’t just tidy up your assortment — it becomes a driver of growth and loyalty.

At Omnibus, our workshop model helps teams apply this role–strategy–shopper logic directly to their own categories, using templates and live discussions to make tough SKU choices visible and practical. With Alvin as an AI support, you can test different assortment scenarios in real time—seeing which cuts streamline the shelf without hurting sales. Together, they turn assortment optimization from guesswork into a structured, data-driven, and shopper-aligned process.

Relevant (often leaner) assortments, higher turnover, stronger loyalty.

For more info, explanations & order of the Assortment Optimization Workshop fill the contact form or write me an e-mail simon@omnibus.si!

Omnibus